Financial Ratios Cheat Sheet 2025 | All Formulas & Quick Reference

Complete financial ratios cheat sheet with formulas. Key accounting ratios for profitability, liquidity, leverage & efficiency in one place.

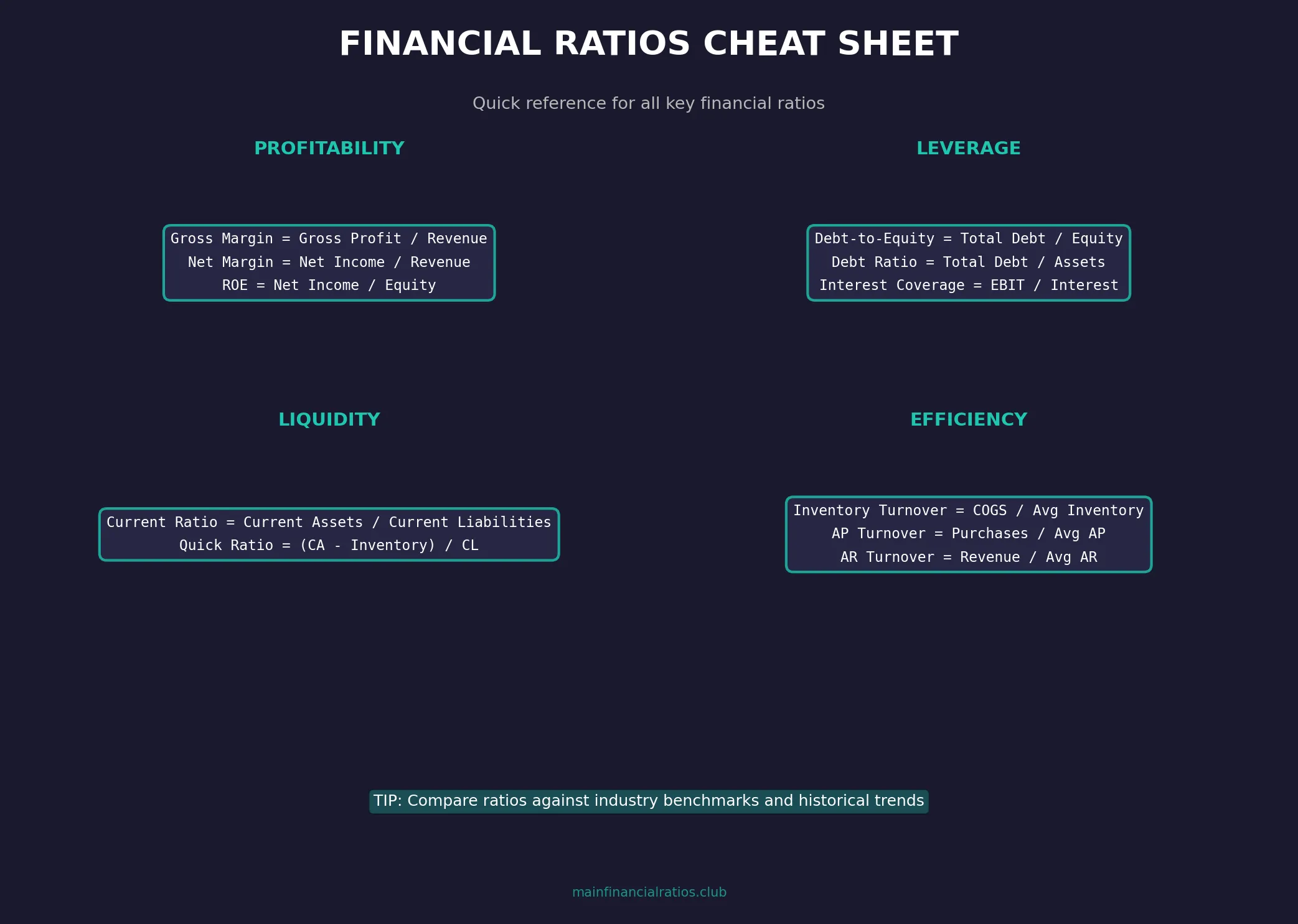

Financial Ratios Cheat Sheet

Your complete quick-reference guide to the most important financial ratios. Bookmark this page for easy access to all key accounting ratios formulas whenever you need them.

Looking for in-depth explanations? Visit our main financial ratios hub for comprehensive guides on each category.

Overview

Financial ratios are grouped into four main categories:

- Profitability Ratios — Measure earnings performance

- Liquidity Ratios — Assess short-term solvency

- Leverage Ratios — Evaluate debt levels

- Efficiency Ratios — Analyze operational effectiveness

Profitability Ratios

Profitability ratios reveal how well a company generates profit from its operations. Learn more about profitability ratios →

Gross Profit Margin

Gross Profit Margin = (Revenue - COGS) / Revenue × 100

What it shows: The percentage of revenue remaining after direct costs. Higher is better.

Typical range: 20% - 60% (varies by industry)

Net Profit Margin

Net Profit Margin = Net Income / Revenue × 100

What it shows: The percentage of revenue that becomes actual profit after all expenses.

Typical range: 5% - 20%

Return on Equity (ROE)

ROE = Net Income / Shareholders' Equity × 100

What it shows: How effectively equity is being used to generate profits.

Target: > 15% generally considered good

Return on Assets (ROA)

ROA = Net Income / Total Assets × 100

What it shows: How efficiently assets are being used to generate earnings.

Target: > 5% (industry dependent)

Return on Capital Employed (ROCE)

ROCE = EBIT / (Total Assets - Current Liabilities) × 100

What it shows: Returns generated on long-term capital invested in the business.

Target: Should exceed cost of capital

Liquidity Ratios

Liquidity ratios measure a company’s ability to pay short-term obligations. Learn more about liquidity ratios →

Current Ratio

Current Ratio = Current Assets / Current Liabilities

What it shows: Ability to pay obligations due within one year.

Target: 1.5 - 2.0 (industry dependent)

Quick Ratio (Acid Test)

Quick Ratio = (Current Assets - Inventory) / Current Liabilities

What it shows: Immediate liquidity excluding slow-moving inventory.

Target: > 1.0

Detailed comparison: Current Ratio vs Quick Ratio →

Cash Ratio

Cash Ratio = Cash & Cash Equivalents / Current Liabilities

What it shows: Ability to pay obligations with cash on hand only.

Target: 0.2 - 0.5 (too high may indicate idle cash)

Leverage Ratios

Leverage ratios assess the degree of debt financing. Learn more about leverage ratios →

Debt-to-Equity Ratio

Debt-to-Equity = Total Debt / Shareholders' Equity

What it shows: The mix of debt versus equity financing.

Target: < 1.5 (varies significantly by industry)

Debt Ratio

Debt Ratio = Total Debt / Total Assets

What it shows: Percentage of assets financed by debt.

Target: < 50%

Interest Coverage Ratio

Interest Coverage = EBIT / Interest Expense

What it shows: Ability to pay interest on outstanding debt.

Target: > 3.0x

Equity Ratio

Equity Ratio = Total Equity / Total Assets

What it shows: Proportion of assets financed by shareholders.

Target: > 50%

Efficiency Ratios

Efficiency ratios measure how well a company uses its assets. Learn more about efficiency ratios →

Inventory Turnover

Inventory Turnover = Cost of Goods Sold / Average Inventory

What it shows: How many times inventory is sold and replaced per year.

Target: Higher is generally better (4-8 turns common)

Accounts Receivable Turnover

AR Turnover = Net Credit Sales / Average Accounts Receivable

What it shows: How efficiently credit sales are collected.

Target: Higher is better (10-12 common)

Accounts Payable Turnover

AP Turnover = Total Purchases / Average Accounts Payable

What it shows: How quickly a company pays its suppliers.

Detailed guide: Accounts Payable Turnover Ratio →

Asset Turnover

Asset Turnover = Revenue / Average Total Assets

What it shows: Revenue generated per dollar of assets.

Target: Varies widely (0.5 - 2.5)

Days Conversion Formulas

Convert turnover ratios to days for easier interpretation:

| Metric | Formula |

|---|---|

| Days Inventory Outstanding | 365 / Inventory Turnover |

| Days Sales Outstanding | 365 / AR Turnover |

| Days Payable Outstanding | 365 / AP Turnover |

| Cash Conversion Cycle | DIO + DSO - DPO |

Complete Formula Quick Reference Table

| Category | Ratio | Formula |

|---|---|---|

| Profitability | Gross Margin | (Revenue - COGS) / Revenue |

| Net Margin | Net Income / Revenue | |

| ROE | Net Income / Equity | |

| ROA | Net Income / Total Assets | |

| ROCE | EBIT / Capital Employed | |

| Liquidity | Current Ratio | Current Assets / Current Liabilities |

| Quick Ratio | (CA - Inventory) / CL | |

| Cash Ratio | Cash / Current Liabilities | |

| Leverage | D/E Ratio | Total Debt / Equity |

| Debt Ratio | Total Debt / Assets | |

| Interest Coverage | EBIT / Interest Expense | |

| Efficiency | Inventory Turnover | COGS / Avg Inventory |

| AR Turnover | Revenue / Avg AR | |

| AP Turnover | Purchases / Avg AP | |

| Asset Turnover | Revenue / Avg Assets |

How to Use This Cheat Sheet

Identify your analysis goal — Are you assessing risk, performance, or efficiency?

Select relevant ratios — Don’t calculate everything; focus on what matters for your decision.

Compare appropriately — Always benchmark against:

- Industry averages

- Historical trends

- Competitor performance

Look for patterns — One ratio rarely tells the whole story. Combine metrics for deeper insights.

Consider context — A “bad” ratio might be acceptable given the company’s strategy or lifecycle stage.

Print-Friendly Version

Need this cheat sheet for offline use? Press Ctrl+P (or Cmd+P on Mac) to print this page.

Related Resources

- Profitability Ratios Guide

- Liquidity Ratios Explained

- Leverage Ratios Formula & Interpretation

- Efficiency Ratios & Working Capital

- Return to Main Financial Ratios Home

Last updated: December 2025