Current Ratio and Quick Ratio: Complete Guide

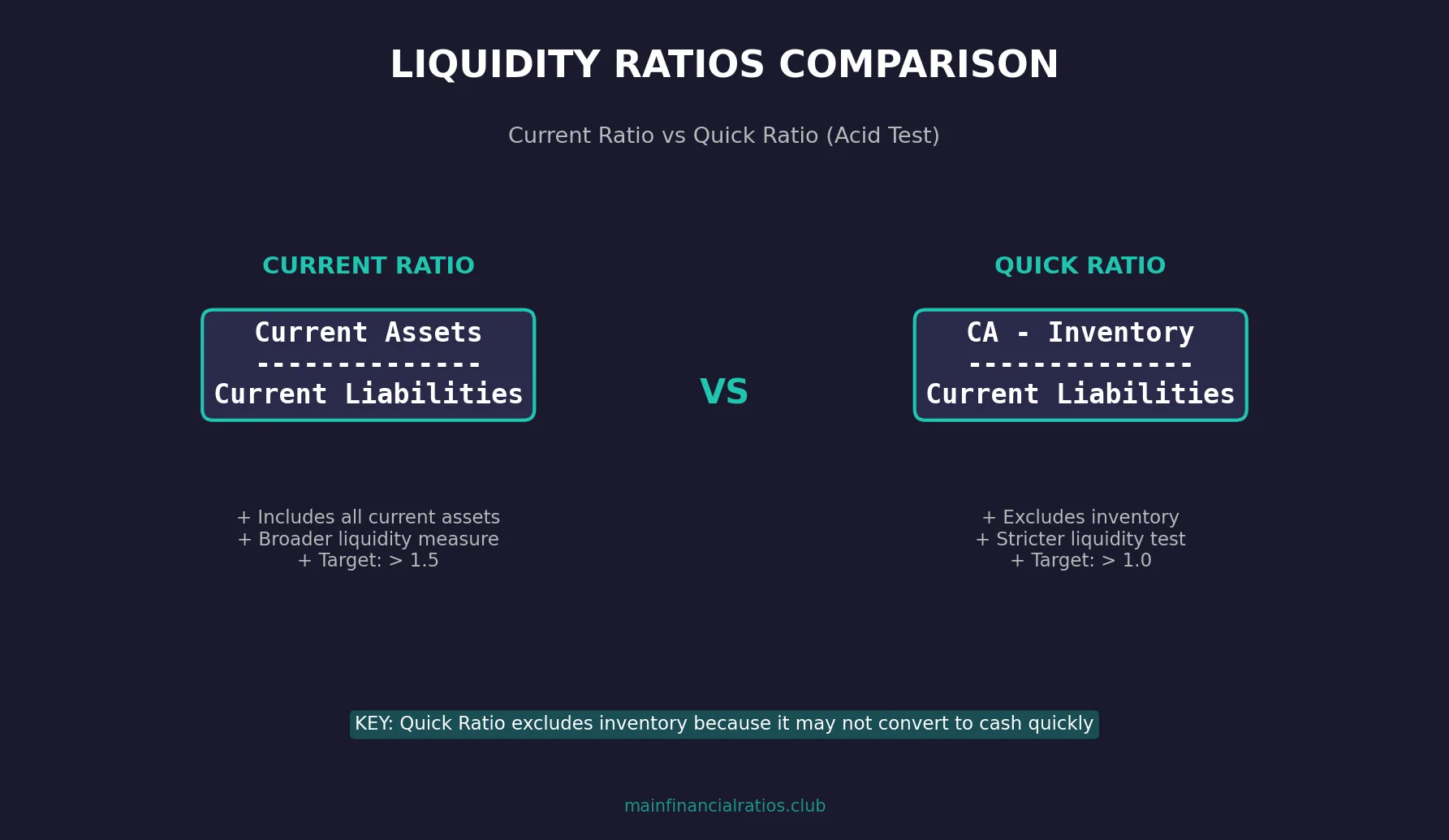

The current ratio and quick ratio are the two most important liquidity metrics in financial analysis. Both measure a company’s ability to pay short-term obligations, but they differ in one crucial way: how they treat inventory.

This guide explains both formulas, when to use each, and how to interpret the results. For all liquidity metrics, return to our main financial ratios hub.

Formula Comparison

Current Ratio Formula

Current Ratio = Current Assets / Current Liabilities

The current ratio includes all current assets:

- Cash and cash equivalents

- Marketable securities

- Accounts receivable

- Inventory

- Prepaid expenses

Quick Ratio Formula (Acid Test)

Quick Ratio = (Current Assets - Inventory) / Current Liabilities

Or alternatively:

Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

The quick ratio excludes inventory because it may not convert to cash quickly.

Key Differences Explained

| Aspect | Current Ratio | Quick Ratio |

|---|---|---|

| Inventory | Included | Excluded |

| Strictness | Less conservative | More conservative |

| Speed focus | All short-term assets | Only liquid assets |

| Best for | General liquidity | Immediate liquidity |

| Ideal range | 1.5 - 2.0 | > 1.0 |

Why Exclude Inventory?

The quick ratio removes inventory because:

- Slow conversion: Inventory may take weeks or months to sell

- Valuation uncertainty: Inventory values can fluctuate or become obsolete

- Industry variation: Retail and manufacturing carry more inventory than service businesses

- Worst-case scenario: In a liquidity crisis, inventory may need to be sold at a discount

How to Calculate: Step-by-Step Example

ABC Corporation Balance Sheet (Current Items):

| Asset/Liability | Amount |

|---|---|

| Cash | $50,000 |

| Accounts Receivable | $80,000 |

| Inventory | $120,000 |

| Prepaid Expenses | $10,000 |

| Total Current Assets | $260,000 |

| Accounts Payable | $60,000 |

| Short-term Debt | $40,000 |

| Accrued Expenses | $20,000 |

| Total Current Liabilities | $120,000 |

Current Ratio Calculation:

Current Ratio = $260,000 / $120,000 = 2.17

Interpretation: ABC Corp has $2.17 in current assets for every $1 of current liabilities. This is a healthy ratio.

Quick Ratio Calculation:

Quick Ratio = ($260,000 - $120,000) / $120,000 = 1.17

Or using the alternative formula:

Quick Ratio = ($50,000 + $80,000) / $120,000 = 1.08

(Note: The slight difference is due to prepaid expenses, which some analysts exclude)

Interpretation: ABC Corp has $1.17 in liquid assets for every $1 of current liabilities. This is adequate but less comfortable than the current ratio suggests.

When to Use Each Ratio

Use the Current Ratio When:

- Analyzing companies with fast-moving inventory (grocery stores, fuel retailers)

- Inventory is highly liquid and easily converted to cash

- Performing general liquidity assessment

- Comparing companies with similar inventory profiles

Use the Quick Ratio When:

- Inventory is slow-moving or perishable

- Assessing immediate ability to pay obligations

- Analyzing service companies with minimal inventory

- Evaluating companies in financial distress

- Comparing companies across different industries

Industry Considerations

Different industries have naturally different liquidity profiles:

| Industry | Typical Current Ratio | Typical Quick Ratio |

|---|---|---|

| Software/Tech | 2.0 - 3.0 | 2.0 - 3.0 (similar—little inventory) |

| Retail | 1.5 - 2.5 | 0.5 - 1.0 (heavy inventory) |

| Manufacturing | 1.5 - 2.0 | 0.8 - 1.2 |

| Utilities | 0.8 - 1.2 | 0.5 - 0.8 |

| Banking | N/A | N/A (different metrics apply) |

The Gap Matters

Pay attention to the difference between current and quick ratios:

- Small gap: Inventory is a minor component of current assets (typical for service businesses)

- Large gap: Company relies heavily on inventory (watch for obsolescence risk)

Interpreting Results

Current Ratio Benchmarks

| Ratio | Interpretation |

|---|---|

| < 1.0 | Concern: Liabilities exceed current assets |

| 1.0 - 1.5 | Adequate: Can meet obligations but limited safety margin |

| 1.5 - 2.0 | Healthy: Good liquidity position |

| 2.0 - 3.0 | Strong: Comfortable liquidity |

| > 3.0 | Very high: May indicate inefficient asset use |

Quick Ratio Benchmarks

| Ratio | Interpretation |

|---|---|

| < 0.5 | Warning: May struggle to pay bills immediately |

| 0.5 - 1.0 | Moderate: Acceptable for inventory-heavy businesses |

| 1.0 - 1.5 | Healthy: Good immediate liquidity |

| > 1.5 | Strong: Excellent short-term financial position |

Common Mistakes to Avoid

Comparing across industries: A quick ratio of 0.6 is concerning for a tech company but normal for a retailer.

Ignoring trends: A declining ratio over several quarters is more concerning than a single low reading.

Not considering quality: High accounts receivable can inflate ratios, but if customers don’t pay, it’s meaningless.

Forgetting off-balance-sheet items: Committed credit lines can supplement liquidity but won’t show in these ratios.

Overlooking seasonality: Retailers may have very different ratios before vs. after holiday season.

Relationship to Other Ratios

Liquidity ratios work best when combined with other metrics:

- Cash Ratio: Even stricter—uses only cash and equivalents

- Working Capital: The dollar amount (not ratio) of current assets minus current liabilities

- Operating Cash Flow Ratio: Measures actual cash generation

Quick Reference Summary

| Metric | Formula | Target |

|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | 1.5 - 2.0 |

| Quick Ratio | (CA - Inventory) / CL | > 1.0 |

Related Resources

- Back to Liquidity Ratios Overview

- Leverage Ratios Guide

- Financial Ratios Cheat Sheet

- Return to Main Financial Ratios Home

Last updated: December 2025